Introduction

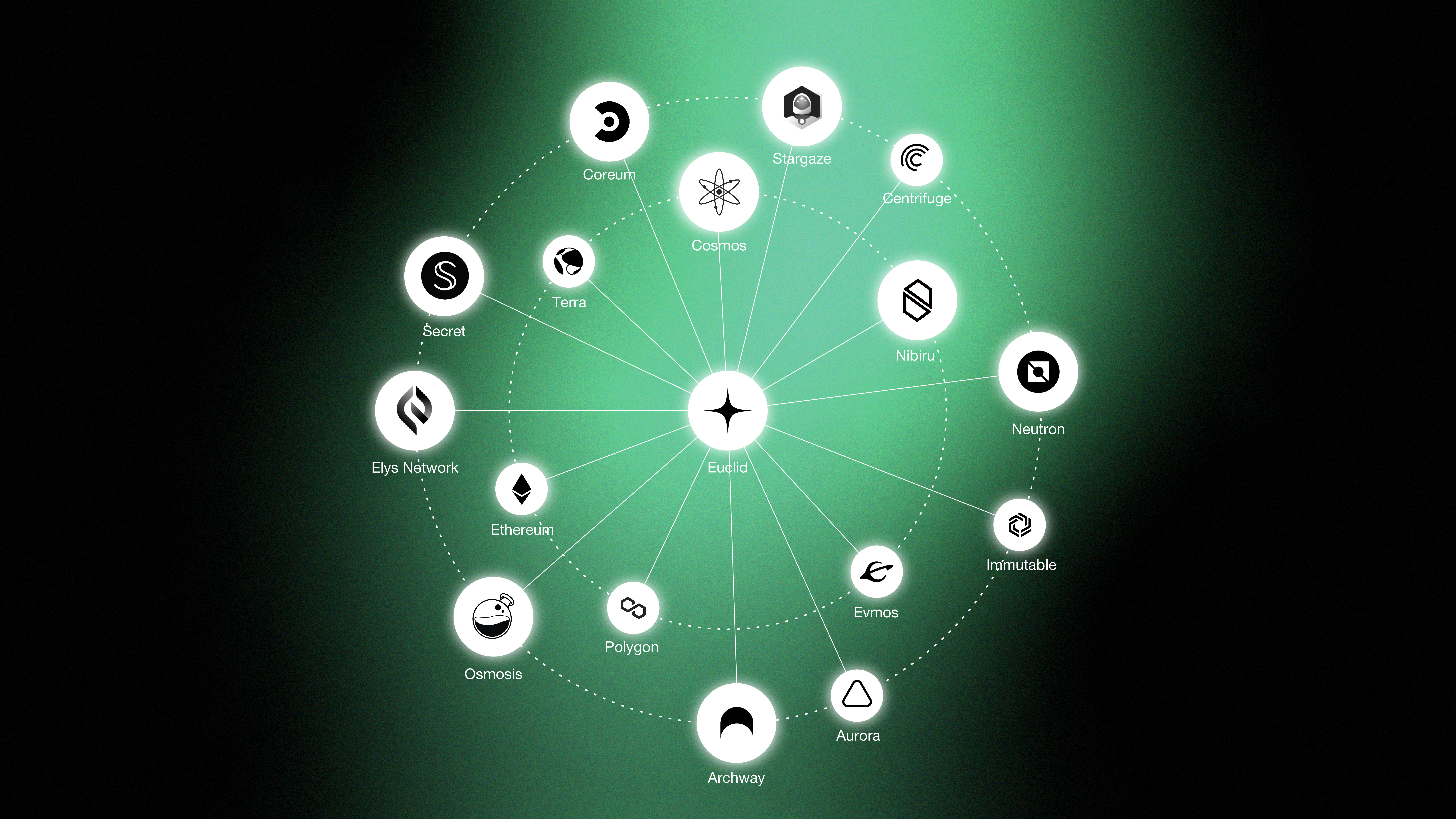

Euclid is an open-source, decentralized liquidity consensus layer designed to enable any application to integrate into a shared liquidity framework. By establishing a consensus-driven layer that connects blockchains, Euclid fosters a collaborative ecosystem where participants benefit from increased liquidity, faster settlements, and a seamless trading experience.

Furthermore, Euclid's modular architecture empowers dApps to access a vast pool of liquidity from any integrated chain, enabling them to easily interact with tokens across the entire ecosystem.

Mission

Euclid is not restriced to any ecosystem and operates on any chain that integrates with the Euclid layer, whether in Cosmos, EVM, Solana or anywhere else.

Euclid's mission is to unlock the true potential of decentralized finance by empowering developers, users, and projects with a robust, permissionless, and efficient protocol for accessing and managing liquidity across the entire blockchain space.

Transforming the DeFi Landscape

The Problems Before Euclid

Before Euclid, the DeFi landscape faced significant challenges due to fragmented liquidity. Limited liquidity on individual DEXs and chains caused significant price fluctuations, particularly for larger trades, resulting in a poor user experience and unpredictable trading costs. Additionally, moving assets between different blockchains was complex and costly, requiring users to navigate bridges and deal with potential security risks and delays. New DeFi projects struggled to attract liquidity, often having to compete with established platforms for a limited pool of users and capital. All of this has created a frustrating and inefficient market and user experience.

What Euclid Offers to the Space

Euclid's unified liquidity protocol directly addresses these challenges, creating a more efficient, secure, interconnected, and user-friendly DeFi ecosystem.

DEXs

Integrating with Euclid enables DEXs to instantly access tokens across all chains connected to the protocol, not just their native environment. For example, if a DEX on Polygon integrates with Euclid, its users can directly swap tokens from Ethereum, Solana, Cosmos, and any other chains integrated with Euclid, lightning fast and without the need to natively support those assets. This dramatically expands trading possibilities for their users. And the best part? No bridging is involved.

In addition to broad token access, integration with Euclid’s liquidity consensus layer provides deeper order books, tighter spreads, and improved pricing through aggregated cross-chain liquidity, making the DEX more competitive and attractive to traders.

Users

For users, Euclid offers a smoother trading experience. Unified liquidity results in less slippage and more predictable pricing, making trading more efficient and user-friendly. Users can also easily trade assets across different blockchains without the need for bridging processes, simplifying cross-chain interactions.

Euclid is truly an all-in-one platform for our user's DeFi needs. Once you’re on Euclid, you never have to leave the ecosystem to swap assets. With everything integrated under one roof, you have unparalleled access to a wide array of tokens, chains, and trading opportunities, making it the ultimate hub for decentralized finance.

Protocols

Integration with Euclid exposes protocols to a wider audience of traders and users across multiple chains, enhancing their visibility within the DeFi ecosystem. Euclid's unified liquidity and interoperability open up a world of new possibilities for these protocols, where they can leverage Euclid's protocol to build innovative cross-chain applications and unlock previously inaccessible use cases, driving further adoption and utility for their tokens.

How is Euclid Able to Offer all of the Above?

In the upcoming sections, we will be taking a look at the innovative architecture Euclid has created to be able to tackle all the existing problems in the Defi space.